Ivana Vojáčková 2 years ago Za mě super pomohly a to docela rychle a dobře za mě spokojenost na devše

“I preferred the item for the reason that I had been ready to get my credit score and identity safety. Thanks!”

This analysis is essential for accurately knowledge a brand name's visibility, reliability, and authenticity. We then align the tool's score with our 0-10 ranking system for just a exact evaluation. If we will not obtain a score from this Instrument, Fund.com's Complete Score will depend exclusively about the copyright score.

Monitor your credit score and stories. It really is a good idea to monitor your credit rating and reports regularly to make certain everything is working efficiently.

A refinance mortgage is a house bank loan that replaces your current mortgage that has a new 1. Homeowners often refinance to decreased their payment, pay their financial loan off faster or choose income-out for personal debt consolidation, house repairs or renovations.

In case your credit or deposit prevents you from qualifying for a conventional bank loan, an FHA personal loan could be a pretty choice. Likewise, for those who’re buying a property in a rural location or are suitable for the VA loan, these possibilities might be easier to qualify for. “Govt-backed loans typically goal a specific demographic,” suggests Darren Tooley, senior loan officer at Cornerstone Monetary Companies.

To assess how nicely-recognized and trustworthy the models are on our list, we use a robust Device for competitive investigate and website traffic analytics. This Software provides us comprehensive insights into both of those cellular and desktop Web site website traffic, enabling us to analyze consumer interactions, search tendencies, and engagement metrics.

Together with these prevalent forms of mortgages, there are other types you may perhaps encounter when purchasing about for a personal loan: Building financial loans

Lenders also look at the loan-to-benefit ratio (LTV) when analyzing home personal loan rates. This amount signifies the quantity you are going to borrow compared to the value of your house. The LTV needs to be less than eighty% for the lowest mortgage prices.

Investopedia contributors come from a range of backgrounds, and above 24 many years there are already Many expert writers and editors who've contributed.

Use credit frequently. It could be tough for lenders to know the way responsible you're with credit in the event you under no circumstances use it. The truth is, FICO requires that you've got credit-related action in the past six months to even qualify for just a score.

Read the fine print with the preapproval to ensure it will likely not have an here effect on your credit rating or compromise your own information.

Lenders evaluate 4 facets of your finances to evaluate whether or not you meet the least mortgage necessities for a mortgage preapproval: one. Your credit scores

It usually takes Practically a decade before you crack even, so ensure that it will make money feeling before you go forward.

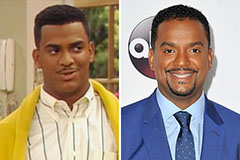

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!